Do imports of cheap solar panel and other technologies help or hurt domestic jobs in clean energy?

Without a comparative advantage, cheaper energy imports often help domestic jobs.

If you want to grow a domestic job market for clean energy, importing cheaper solar panels, wind turbines, and batteries from other countries (mostly China) seems like a bad idea. A manufacturing job that could be done by an American or a European is being offshored to a Chinese worker instead.

This is one of several arguments that countries make for protectionist trade policies such as tariffs, local production mandates, and import quotas.

This framing makes sense when thinking purely about manufacturing jobs in clean energy. But it’s not so straightforward when thinking about clean energy jobs as a whole. Many jobs are in the deployment, installation, permitting, and operation of solar panels, wind farms, and storage projects (which cannot be offshored).

So there’s a counterargument that by refusing cheaper technology from China (or elsewhere) — either by adding tariffs or insisting on more expensive domestic production — you are slowing down the adoption and installation of clean energy. People will install fewer, which means fewer jobs in deployment and operations.

There’s some trade-off. You can increase manufacturing jobs in the US or the EU, but because products are more expensive, this comes at the cost of jobs in other parts of the supply chain.

I wanted to look at some of the data that would help me understand this dynamic. To be clear: there are other reasons why a country would want to focus on domestic production, such as energy security. But here I’m focusing only on total employment numbers.1

Most solar jobs are in deployment, not manufacturing

When it comes to solar power, most jobs are in installation, deployment and maintenance. They are not in manufacturing.

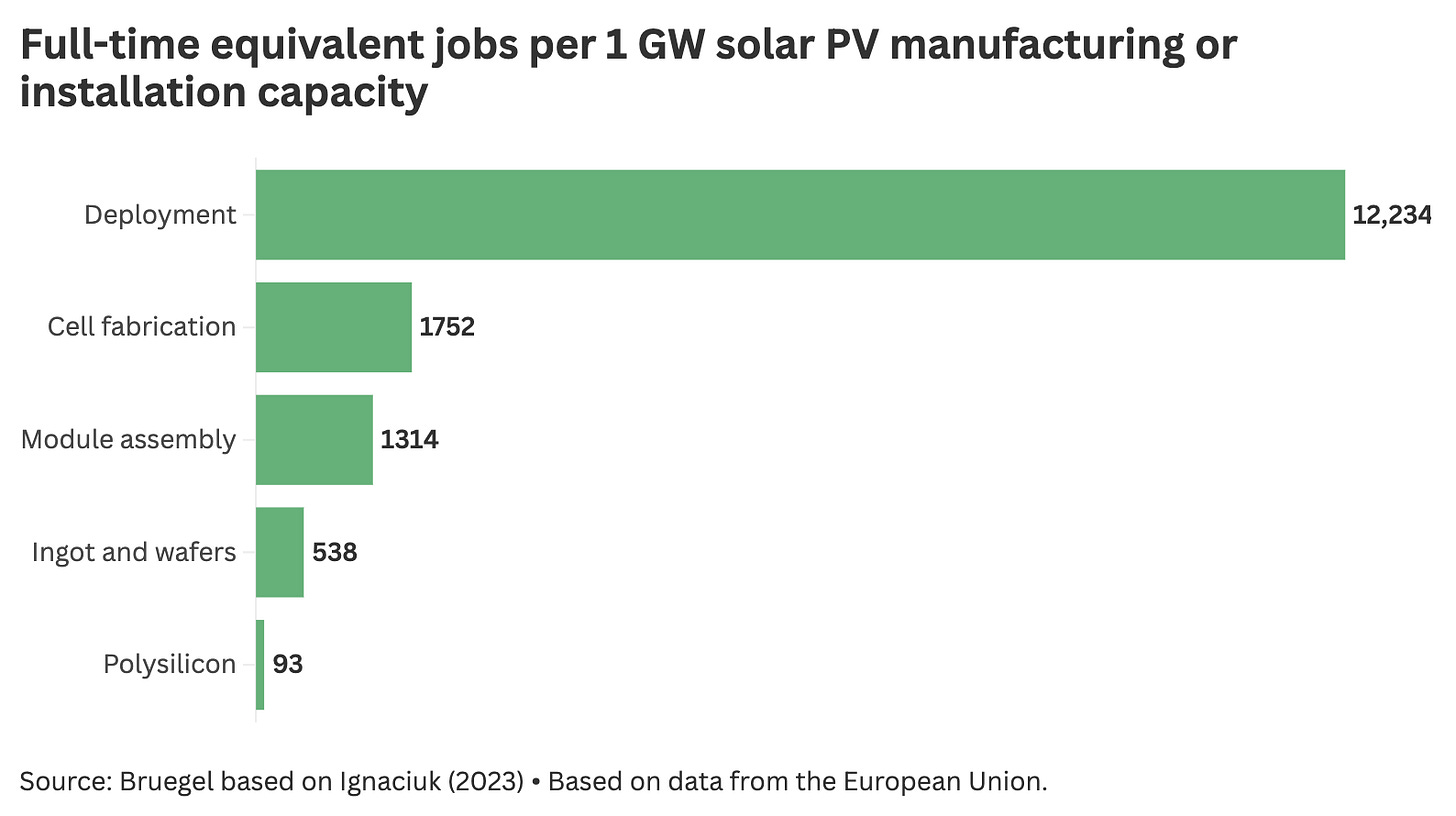

The chart below is based on data from Europe. Every gigawatt of solar PV generates around 12,000 full-time jobs in deployment. Add up all of the manufacturing components, and it comes to around 4,000. Three jobs in other parts of the supply chain for every one job in manufacturing.

If we look at US data on solar employment, the distribution is pretty similar. The chart below shows US solar employment since 2010. Again, more than 80% of solar jobs are not in manufacturing.

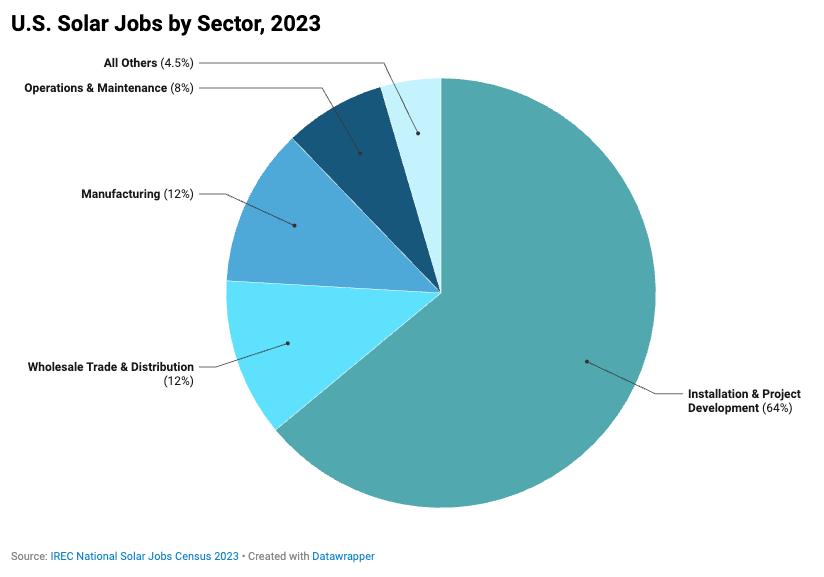

Here’s a clearer view only for 2023: almost two-thirds of American solar jobs were in installation and project development; 12% in trade and distribution; 8% in operations and maintenance; and just 12% in manufacturing.

Of course, we might argue that the manufacturing share is low because America only produces around one-third of its solar panels domestically. If it were producing them all at home, this share would be much higher. This is true, but even if we tripled manufacturing jobs, they’d still only be around one-third of the total.

It’s also helpful to look at data from China, which already produces more than enough for its domestic market. Around 1.6 million people in China are employed in solar photovoltaics. 59% of them are in manufacturing, with the remaining 41% in other parts of the supply chain. But, around 69% of China’s solar panels are exported, with less than a third being used for its domestic market.

If we assume that China was only manufacturing enough for its domestic market, there would only be around 500,000 manufacturing jobs. Since 1.1 million work in other parts of the solar supply chain, manufacturing would only be around one-third of the total. That’s two other solar jobs for every one manufacturing job.

The only way to argue that manufacturing jobs would outnumber those in deployment, permitting, and operations is if the US didn’t just produce solar panels for its domestic market, but exported them too. This won’t happen because they can’t compete on price. Why would countries take the more expensive American panel over the cheaper, same-quality Chinese one? The US has no comparative advantage.

A year ago, you might have argued that countries would see the US as a more reliable trading partner — and worth the extra cost — but the US has now ruined that reputation.

Solar deployment creates jobs in other parts of the clean energy ecosystem, such as grids and storage

So far, we’ve focused narrowly on jobs in the solar market. But these create spillovers for other parts of the energy system.

If we install more renewable energy, we need more engineers to expand and maintain the power grid and people to construct energy storage projects.

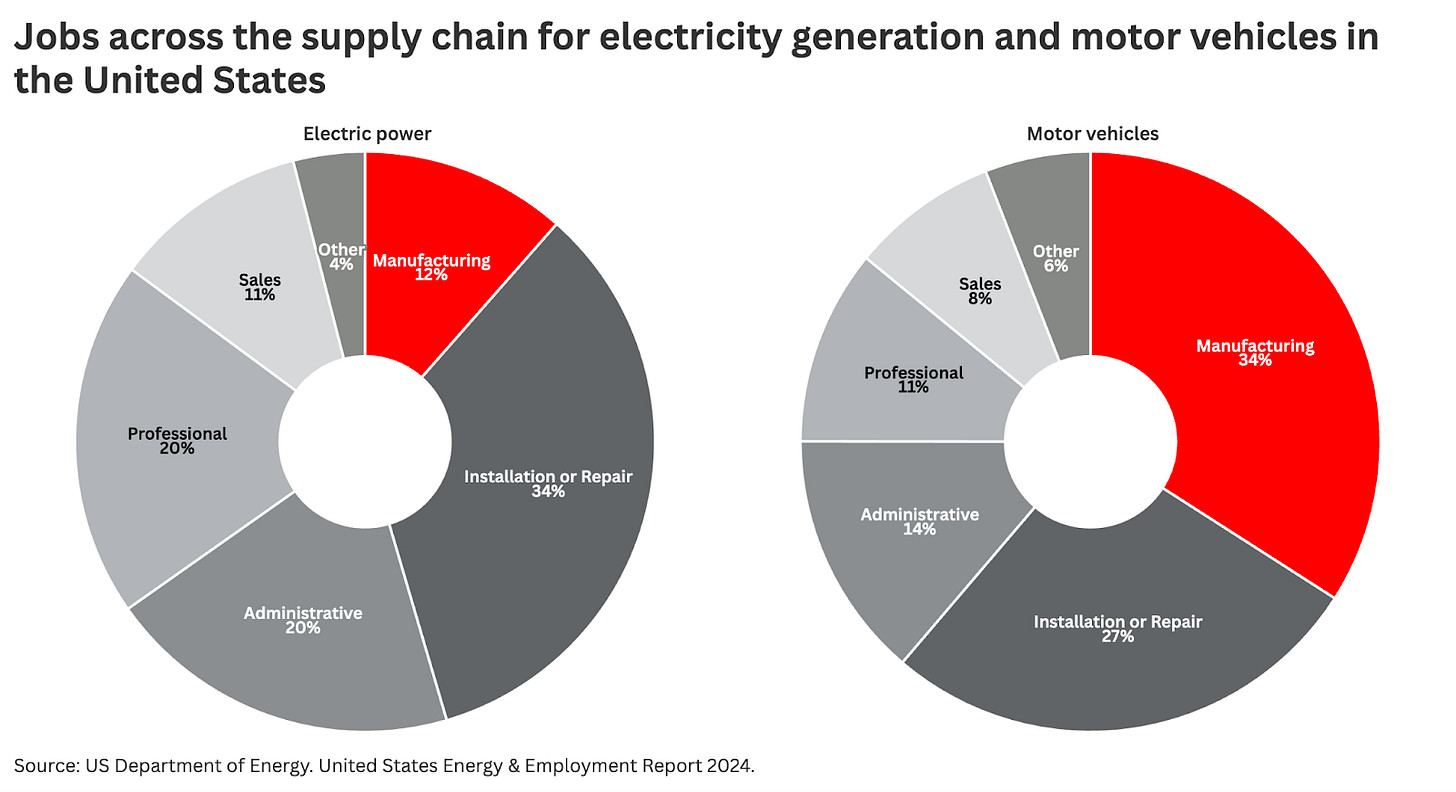

Again, these jobs are heavily concentrated in installation, utilities, operations, and maintenance. See the chart below.

The faster we deploy renewables, the more jobs are created in these supply chains.

Solar tariffs do increase manufacturing jobs, but probably at the expense of other solar jobs

To do a proper, in-depth analysis of this trade-off, we would need high-quality data on the price elasticity of solar PV in the EU or the US. The debate hinges on the assumption that if panels are more expensive, fewer people buy and install them. This is correct, I just don’t know how many fewer people buy them for a given change in price. That’s the price elasticity.

Other organisations, though, have assessed the impact of trade interventions such as tariffs on solar jobs. An analysis by SEIA suggested that for every American manufacturing job created by import tariffs came at the “cost” of 5.3 megawatts of solar being deployed, and 31 additional jobs being lost. Again, this is because tariffs increase the cost of imports, which can support domestic manufacturing, but they push the price of solar panels up, and people buy fewer.

Analysis in Europe (which is even more dependent on Chinese imports, but always talks about reshoring manufacturing jobs) suggests the same.

Production subsidies can avoid some of these trade-offs

This dynamic exists because other countries can produce solar panels or other tech at a lower cost than the US or the EU can. Making imports more expensive — via tariffs — is one way to level the playing field. Another is to subsidise domestic production.

If the government provides economic support for producers, they can bring domestic costs down and closer to panels, turbines or batteries from China.

That avoids most of this labour trade-off: manufacturing jobs can stay high, and countries keep deploying and installing this technology quickly (because the costs remain low).

Of course, this isn’t a free lunch. The money for the subsidies comes from taxpayers, so there is a trade-off elsewhere: more money going into solar manufacturing means less for health, education, social services, or other government support programs.

A final note on the types of jobs created

Again, I’ve focused on the total number of jobs created. But there are often socioeconomic and political reasons why we’d be more in favour of stimulating certain types of jobs over others.

If a particular region has plentiful opportunities for white-collar roles, but a vanishing job market for blue-collar work, then it might favour a comeback of manufacturing jobs, even if it comes at the expense of overall jobs.

It’s worth noting, though, that many of the non-manufacturing clean energy jobs are still highly practical and would be considered blue-collar work.

Those in installation, operations, and maintenance are better served through an apprenticeship than a university degree. While some parts of the supply chain — especially those in project management, trade and distribution — do typically expect a bachelor’s degree or higher, less than half (43%) of all solar jobs in the US required a bachelor’s degree.

Appendix

A few pieces of additional data you might find interesting:

What about wind and other energy sources?

In the table below, you can find the distribution of jobs in our energy sources across the supply chain in the United States. Most tend to be concentrated in utilities and construction, rather than manufacturing (with the exception of oil).

Manufacturing makes up a bigger share of jobs in the vehicle market

Countries are also imposing hefty tariffs on car imports, citing the same concerns about the loss of domestic jobs.

This argument makes a bit more sense here. As you can see in the chart below, manufacturing accounts for more than one-third of the jobs in the motor vehicle supply chain, compared to just 12% in electricity generation.

I'm not even focused on emissions reductions or energy costs. I'm only looking at the number of jobs.

Great info Hannah. Another point is that since American labor is much more expensive than Chinese labor (about 4-7x), whatever manufacturing is brought to America by taxing imports will likely involve much more automation and robotics to be financially feasible.

jaberwock

jaberwock’s Newsletter

Mar 31, 2024

The whole "job creation" concept is nonsense.

The jobs are either replacing existing jobs, in which case no net jobs are being created. Or they are additional jobs, in which case more jobs are required for the same benefit, the jobs are less efficient and by implication more expensive than the replaced jobs.