We have enough minerals for the energy transition, but medium-term supply is a challenge [Part 2]

Increased recycling, substitution, mining and refining capacity are all essential if we're to have secure mineral supplies in the medium-term.

The world has enough minerals to move to a low-carbon economy. That was the conclusion from Part 1 of this two-parter.

But it’s not just cumulative long-term demand and supply that matters. We also need to scale up supply in the short- and medium-term. We need to make sure there are no bottlenecks that slow down the transition.

In this post, we’ll look at how annual demand for these minerals could increase in the medium-term, and how this compares to supply.

Short- and medium-term bottlenecks are a bigger problem because opening new mines takes time

In Part One I stressed that projections of long-term demand should be taken with a strong pinch of salt: we want to get a sense of the balance between demand and supply, but most projections will turn out to be wrong.

We’ll find new reserves, battery chemistries will change, and markets will respond to price signals and substitute minerals for more abundant and cheaper alternatives. A discrepancy of 20% in 2050 is probably not something to panic over, but to adjust and plan for.

But we can’t be this ‘flippant’ in the short- and medium-term. That’s because it takes time to discover new deposits, open mines or scale up refining capacity.

The discovery and exploration phase can take over a decade. And even once a deposit has been found, it takes around 5 years of permitting and construction before that mine starts producing. For some minerals it’s even longer.

A report by the Payne Institute – The State of Critical Minerals Report 2023 – notes that it takes 7 to 10 years in the United States to secure a mine permit. That’s very slow by international standards: it’s just 2 to 3 years in Australia and Canada.

The following graphic from the Energy Transitions Commission (ETC) sums this up nicely. It takes a few years at most to build solar modules and open an electric car factory. That’s not the bottleneck. The real limiting factor is the lead times to discovering and opening new mines to produce the minerals that go into them.

So, while we can be slightly more relaxed about long-term supply – because we have time to build markets around these technologies and inputs – we need to think more urgently about near-term supply.

If mineral demand in the next 5 to 10 years is going to double, triple, or more then we need to be opening new mines, scaling up refining capacity, and securing supply now. Even then, given the timescales above, we probably need a process to accelerate the standard lead times. Crucially, we need to do this while maintaining high standards of environmental and social oversight (which is what the process is there for).

Market responses, such as mineral substitution and technology change might be able to absorb some shortfalls. But probably not all of them, slowing down the transition.

How much will mineral production need to increase by 2030?

What magnitude of increase are we talking about?

Let’s focus on the medium-term demand out to 2030.

Most sources agree that in the very short-term – in the next few years – supplies will be sufficient to meet demand. But 5 to 10 years down the line, and demand accelerates a lot.

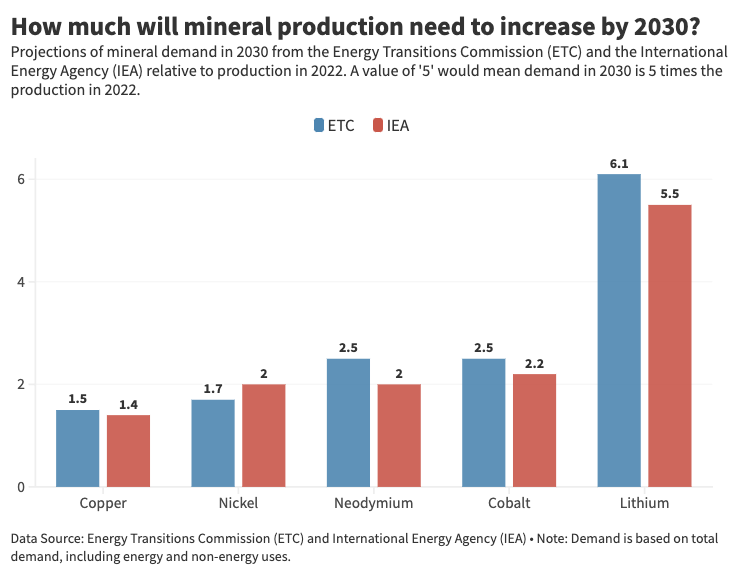

In the chart below I’ve shown the increase in production needed by 2030 across various critical minerals. In blue are estimates from the Energy Transitions Commission (ETC) and in red, from the International Energy Agency (IEA). The IEA has a data explorer where you can look at demand across different scenarios.

Both are based on net-zero scenarios to 2050. And they show the relative increase in levels of production in 2022. So, a value of ‘2’ means that production would have to double by 2030.

This is based on total demand for these minerals, not just demand for energy technologies.

Their estimates are fairly similar. Copper production would have to increase by around 50%. Nickel would have to double. Neodymium and cobalt would need to increase 2 to 2.5-fold. And lithium demand will be around 6 times higher.

As I mentioned in Part One, demand estimates from the ETC and IEA tend to be on the higher end. See the comparison of sources for nickel from the Payne Institute below.

So we might take these as high estimates (which we should do, if we want to be conservative and make sure we have sufficient supply in any scenario).

Will global supplies meet this demand in 2030?

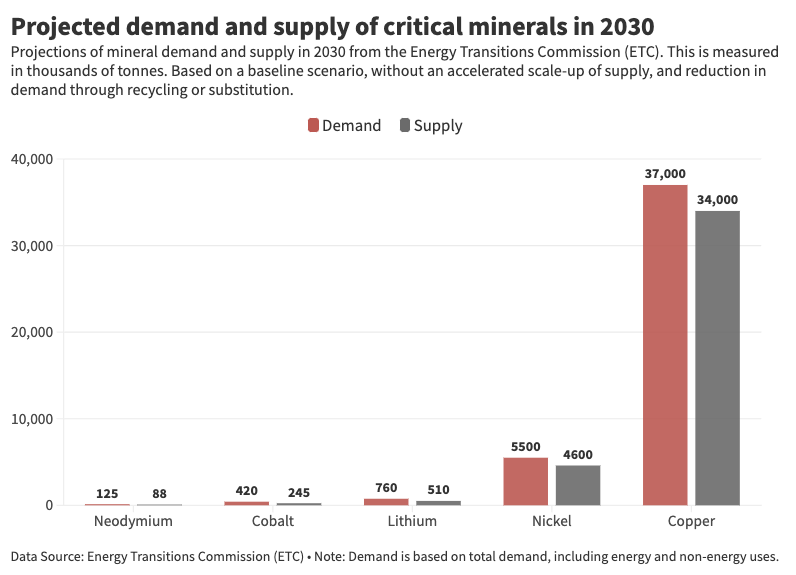

We can compare this demand to projections of supply in 2030. This is based on current mineral outlooks – obviously, this can change if we move faster on mining and refining capacity.

The ETC makes this comparison in its study, based on mineral outlook data.

As you can see, for several critical minerals, the projected supply will fall short. There are significant gaps for cobalt and lithium, in particular.

Can we close the supply-demand gap by 2030?

There are things we can do to close this gap.

We can reduce demand for supply-constrained minerals through enhanced recycling and substitution. ETC models these impacts as part of a ‘lower demand’ scenario for 2030. It’s shown in the chart below.

You can see that most supply gaps are filled. This would require smaller batteries, a switch to sodium-ion chemistries, or lower mineral intensities for lithium. A shift away from cobalt- and nickel-rich battery chemistries, and enhanced recycling. Some replacement of copper with aluminum in grids.

Even in these scenarios, there could still be some shortfall by 2030. That means we also need to accelerate supply availability. New mines need to be opened, and new refining capacity built.

The standard timelines for many mining projects will need to be accelerated to secure supplies in time. Doing this while maintaining strong environmental and governance standards will be a key challenge.

Take a look at the chart below from the International Energy Agency (IEA). It can be more than a decade from discovery to production. Some countries can do it faster: lithium sourcing in Australia is around 4 years. 6 years in South America.

Given the fact that 2030 is now around 6 years away, that’s the pace that would need to be achieved for other minerals.

Midstream processes are an often-overlooked bottleneck

When we think about mineral supplies, we tend to focus on the raw material. The amount of lithium, cobalt, or copper that’s being dug out of the ground.

But, the supply chains of the components used in low-carbon technologies are complex. They have bottlenecks in them that don’t get the same amount of attention.

An example of this is lithium. It’s not used in batteries in its raw form: it needs to be converted into a chemical product, such as lithium carbonate or lithium hydroxide.

There are currently a limited number of companies that convert raw lithium to these chemical products economically, and at scale. If this production capacity is not scaled, these midstream processes could be the limiting factor in supply chains, even if the world can dig enough lithium out of the ground.

Focusing only on raw material supply is a mistake: we need to make sure that we’re building complete and resilient supply chains, from the point of extraction to the final component going into our electric cars or solar panels.

Dr. Gill Pratt, chief scientist at Toyota, has been talking about the medium term lithium scarcity for a couple years. He claims it is part of the reason they have been slow to go all in on EVs, https://insideevs.com/news/650150/toyota-says-ev-extremists-are-wrong/ . I could be biased, I own a Toyota plug-in hybrid. To his point, plug-in hybrids use about 1/6 of the lithium and have similar lifecycle emissions to EVs, https://www.carboncounter.com/#!/explore . Maybe Toyota knows what they're doing after all.

I continue to contend that instead of dictating technology, e.g., percentage of EVs, government policy should be setting guidelines for lifecycle emissions and let manufacturers and innovation determine the right mix of technologies.

I am not sure that this article really gets to the heart of the matter regarding Green energy and raw materials.

I think the biggest concern in this area is a sudden price spike of critical raw materials due to demand getting close to supply. This happens frequently with oil and gas. Given the long time it takes to open up new mines, this could make Green energy far more expensive for a decade. I have no doubt supply will eventually adjust, but that is a long time.

Given that there are only 26 years to get to Net Zero in 2050, this one factor could derail the whole Green energy agenda.